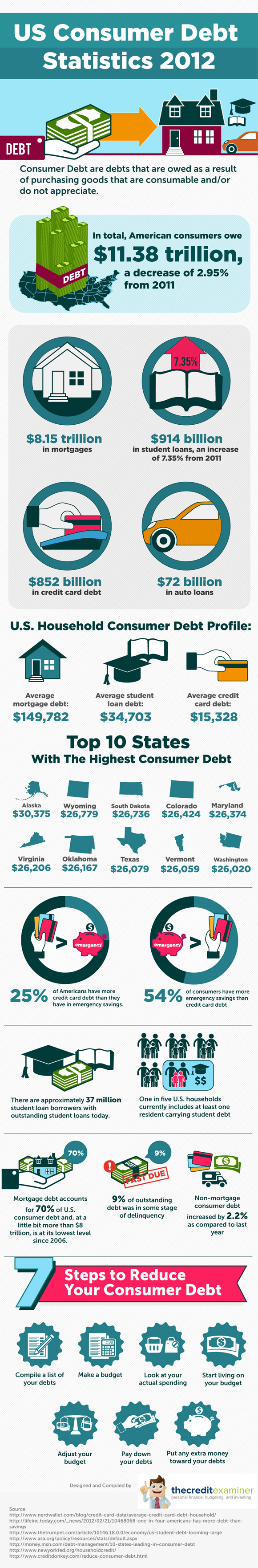

While overall US consumer debt was down in 2012, the number is still staggering at 11 trillion dollars, with one of the largest being student loans, which is now higher than US consumer credit card debt. The below infographic breaks down some of the surprising and interesting statistics surrounding people’s spending habits and debt.

Source: The Credit Examiner